A recent survey conducted by Paysafe Group has revealed that the adoption of artificial intelligence (AI) in digital payments still faces significant hurdles among consumers worldwide in 2023. The survey, which spanned 14 countries across North America, Europe, and Latin America, shed light on consumers’ discomfort and reluctance to embrace AI-driven payments technology.

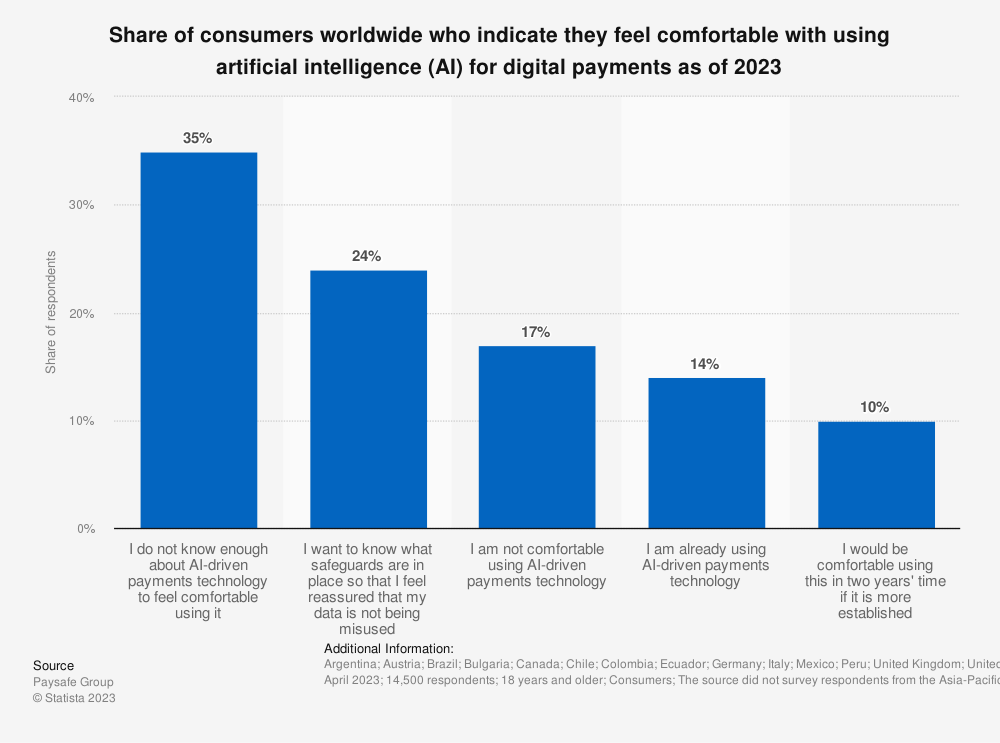

According to the Paysafe Group survey conducted in 2023, only 14% of respondents indicated feeling comfortable with using AI for digital payments. This figure highlights a prevalent hesitation among consumers, suggesting that the majority are not yet ready to fully embrace this innovative payment method.

Trust for Artificial Intelligence in Digital Payments

The study identified two primary factors contributing to consumers’ reservations regarding AI-driven payments technology. Firstly, 35% of respondents cited a lack of awareness and understanding about the underlying processes involved as a key reason for their discomfort. Many consumers may not be familiar with the intricate machine learning algorithms and background operations that power these systems. This lack of knowledge can lead to skepticism and concerns about the potential risks associated with AI-driven payments.

Furthermore, 24% of respondents expressed the need for safeguards and reassurances regarding the protection of their personal and financial data. With the rising number of data breaches and cyber threats, consumers are increasingly cautious about sharing sensitive information online. This caution extends to AI-driven payments, as consumers demand transparency and stringent security measures to safeguard their data.

While the survey results indicate a lack of current comfort levels with AI-driven payments technology, there is a glimmer of optimism for the future. Approximately 10% of respondents expressed their willingness to consider using AI-driven payments in two years’ time, but only if the technology becomes more established.

To bridge the gap and foster wider acceptance, industry stakeholders and organizations must invest in educational initiatives to raise awareness about the benefits and safeguards in place with AI-driven payments. Transparent communication about security measures, data practices, and privacy regulations will be vital in building consumer trust and confidence in the technology.

As the world continues to progress technologically, the Paysafe Group survey serves as a reminder that the successful integration of AI-driven payments relies on addressing consumers’ concerns and equipping them with the necessary knowledge. By prioritizing consumer education, data security, and transparent practices, stakeholders can pave the way for a future where AI-driven payments become more widely embraced.