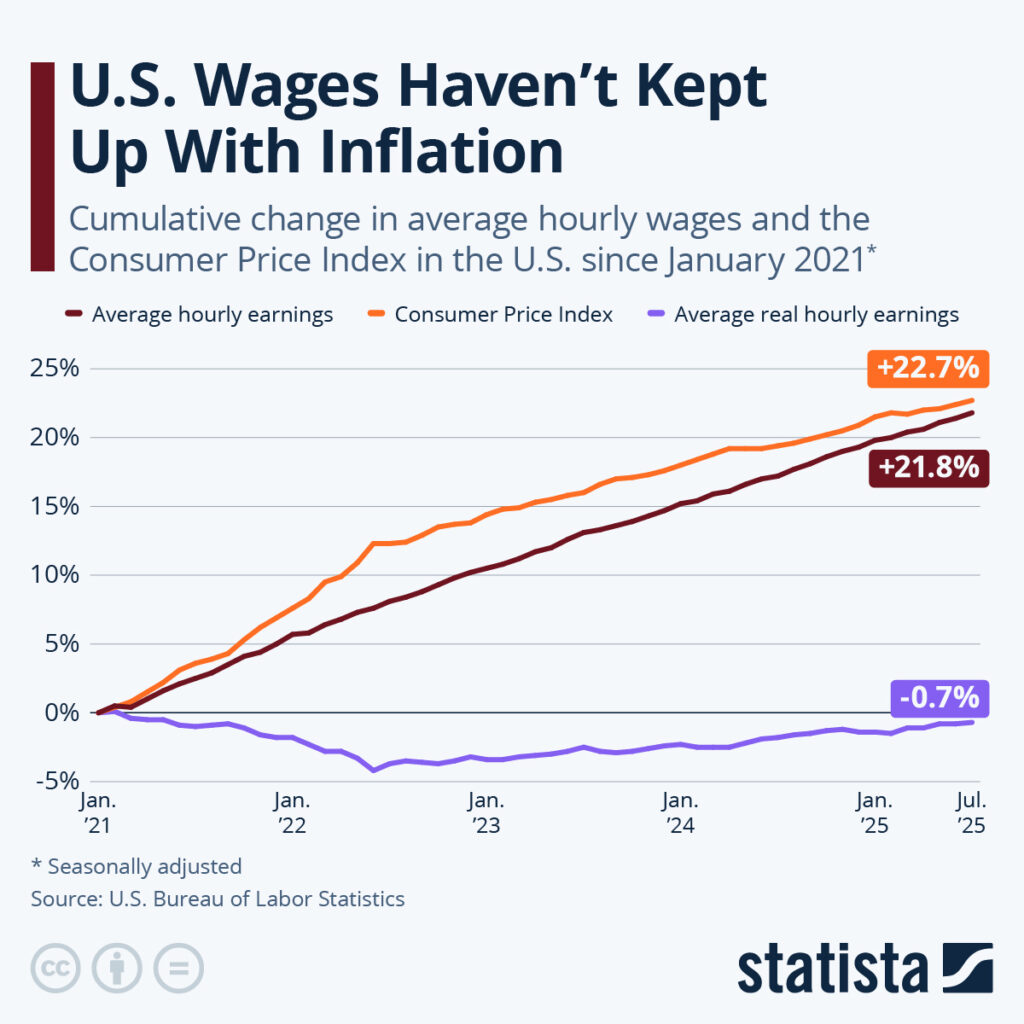

Real wages in the United States have fallen by 0.7 percent since January 2021. That number may sound small, but it captures a larger truth: people often feel poorer even as their paychecks appear larger. Inflation has eroded gains, and although the economy is posting substantial numbers, many families are struggling to keep pace with the rising cost of living.

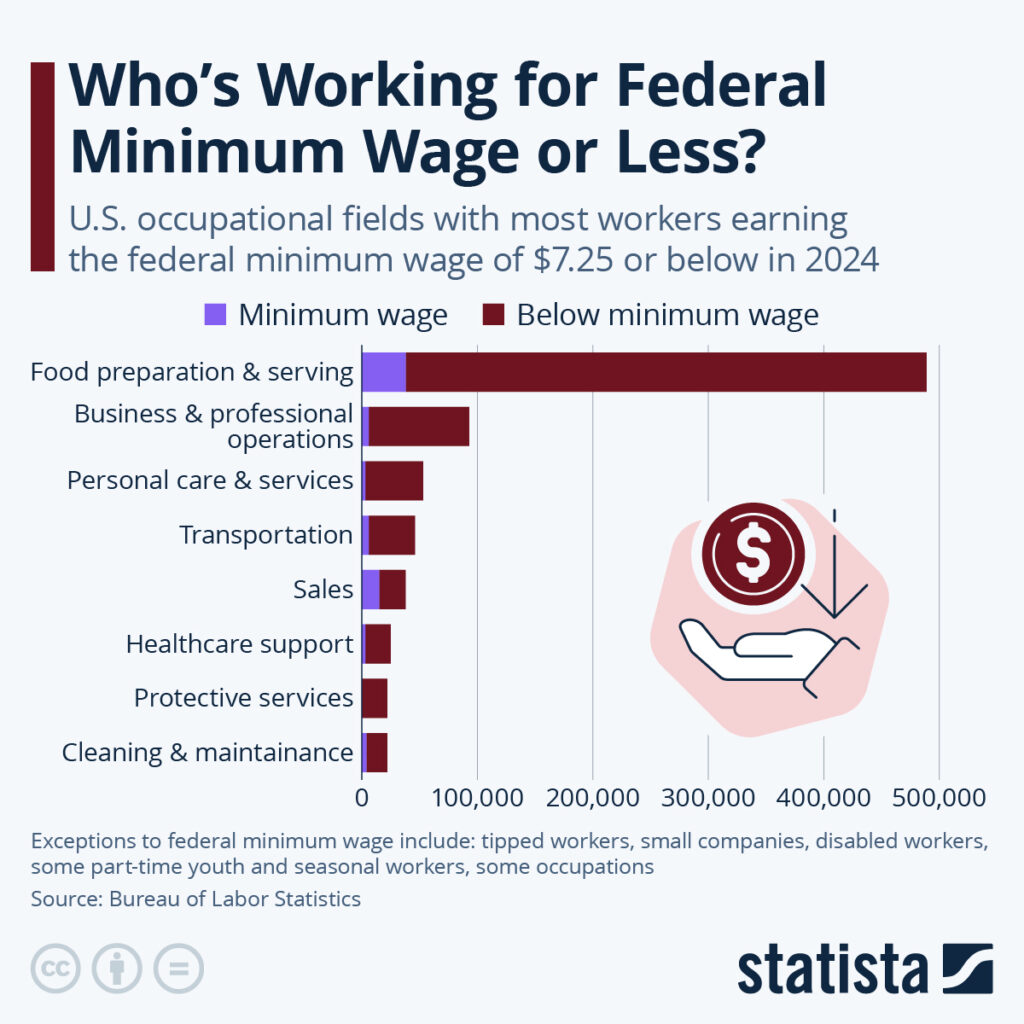

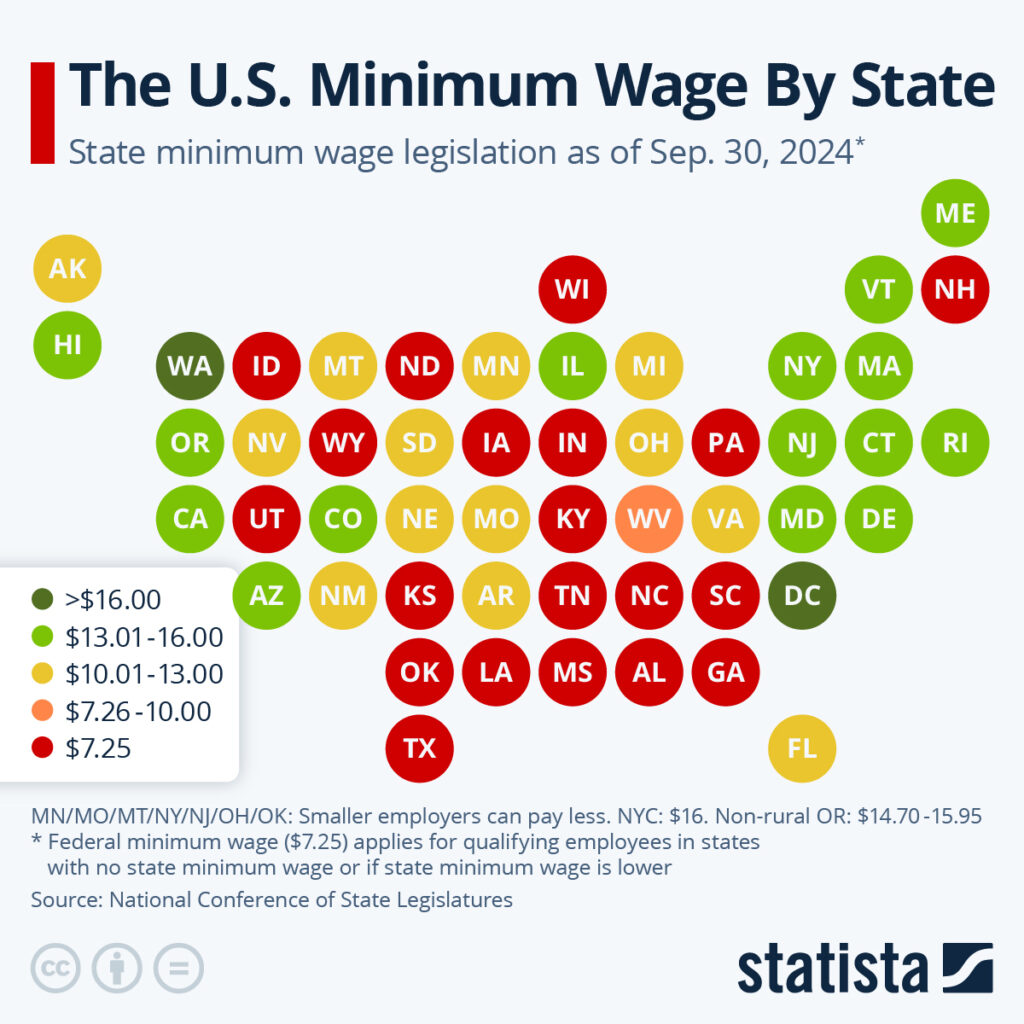

At the same time, the federal minimum wage has been frozen at $7.25 since 2009. In much of the South and Midwest, that’s still the law of the land. Meanwhile, states like California, New York, and Washington have raised their minimums above $16, creating a sharp divide between workers depending on where they live. In Texas alone, 120,000 workers earn at or below the minimum wage. Most of them are in food preparation and service, jobs that have long been excluded from fair pay through loopholes for tipped workers and small employers.

This is the backdrop against which artificial intelligence enters the story. AI is not the cause of inflation, but it may be shaping how wages respond to it. In restaurants, self-order kiosks are replacing cashiers. In retail, self-checkout machines stand where clerks once did. And in call centers, once a classic low-wage job for hundreds of thousands of Americans, chatbots are quietly taking over.

AI chatbots are no longer the clunky “press 1 for this, press 2 for that” systems that frustrate customers. Today, they can understand natural speech, recognize intent, and hold conversations that feel human enough to get the job done. Amazon’s Lex technology, for example, powers chatbots that can reset your password, tell you your account balance, or book an appointment—all without involving a human agent. These chatbots maintain context, ask follow-up questions, and adapt to the caller in real time. They are faster than waiting on hold, and cheaper for companies to run.

From the customer’s perspective, this may feel like progress. No more repeating your information from one agent to another. No more long hold times. But for workers, it means something else: fewer people hired, fewer shifts to go around, and less bargaining power to demand higher wages.

The connection to minimum wages is direct. Call centers, like food service and retail, have long been employers of last resort—jobs that pay close to the minimum wage but offer stability to people without advanced degrees. As AI handles more of the simple tasks, the remaining jobs often require higher skills but not necessarily higher pay. A smaller pool of workers is tasked with managing complex cases, while routine calls are increasingly automated. In the process, thousands of potential entry-level positions evaporate.

This is how AI quietly shapes the wage debate. It doesn’t slash wages directly, but it weakens the leverage of workers who already sit at the bottom of the wage scale. When fewer low-wage jobs are available, the competition among workers becomes more intense. That makes it easier for employers to resist raising wages, especially in states that haven’t updated their minimums in more than a decade. The result is what we see today: nominal wages are rising, but real wages are either stuck or falling.

It would be easy to blame AI for all of this, but that would miss the real point. Technology doesn’t dictate who wins and who loses—policy does. The United States has allowed the federal minimum wage to stagnate while inflation erodes its value. We have not created safety nets for workers whose jobs are displaced by automation. We celebrate productivity gains without asking who benefits from them.

AI may improve customer service, but it risks devaluing labor if we don’t address these structural gaps. The technology makes existing inequalities worse. In states with higher minimum wages, workers are shielded to some degree from the race to the bottom. In states where the minimum wage remains at $7.25, workers are left exposed, competing for fewer jobs while their paychecks lose purchasing power month after month.

Real wages have been falling not just because of inflation, but because the nature of work is changing. AI is not the sole reason people feel left behind, but it is part of why the recovery feels uneven. The real danger is not that AI exists, but that we let it widen cracks in the system that have been ignored for too long.